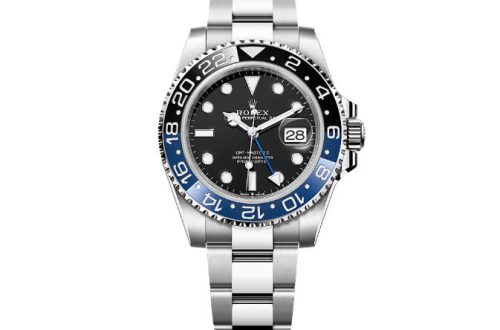

If there must be tariffs, luxury best replica Rolex watches couldn’t be a better place to put them. Slapping hefty tariffs on Switzerland, therefore, home to elite brands such as Rolex and Patek Philippe and the source of $5.4bn of horological exports to the US last year, could be a masterstroke by President Donald Trump.

Swiss fake Rolex watches are well insulated from one of the main risks of tariffs: namely that as costs rise, demand falls, hurting both the companies themselves and the governments attempting to raise cash through the tax. With price tags that can run into tens of millions of dollars, high-end timepieces are a Veblen good. The more expensive they become, the more alluring. As the industry likes to say, those that can buy one, buy six.

For evidence of that axiom look no further than the wrist of Mark Zuckerberg. When he cast aside hoodies and nerdiness to reinvent himself as a man’s man, the founder of Facebook owner Meta did so by embracing jiu-jitsu and luxury AAA Rolex copy watches. When he announced the end of Meta’s third-party fact-checking programme in January, he did so while flossing a $900,000 Greubel Forsey Hand Made 1 watch.

A secondary benefit, albeit possibly an accidental one, is that tariffs on the most expensive accessories burnish the image of a president ostensibly focused on the everyman. Unlike, say, tariffs on Bangladesh — the origin of T-shirts that wind up in racks of affordable retailers — this is a tax that falls on those with means.

Watchmakers may thus be saved from the “horror scenario” — in the words of trade association Swissmem — faced by their fellow Swiss exporters. While carmakers and chipmakers rush to reshore to the US, the horologists can stay put, and not worry too much about reordering supply chains. That’s lucky: the artisanal industry has been solidly Swiss for nearly five centuries.

Swiss horologists are not entirely immune to the waxing ways of the world. The quartz crisis of the 1970s thrashed the industry. More recent challenges include a strong Swiss franc, rampant gold prices and a more general wilting across the luxury sector.

Sales have yet to return to the peaks of the pandemic era, when holidays were cancelled, entertainment curtailed, and savings decanted into bling. Plenty of luxury Perfect clone Rolex watches are worth less than they were a year ago, according to industry tracker ChronoPulse, which tracks second-hand transactions.

But no one buys these for the short-term. Audemars Piguet debuted its inaugural Royal Oak top watches for sale at £2,850 in 1972, well above the average salary at the time; a new model released in 2021 retails at more than 50 times that. As investments go, that is streets ahead of inflation and even pips London property prices. Tariffs come and go, but prestige is timeless.